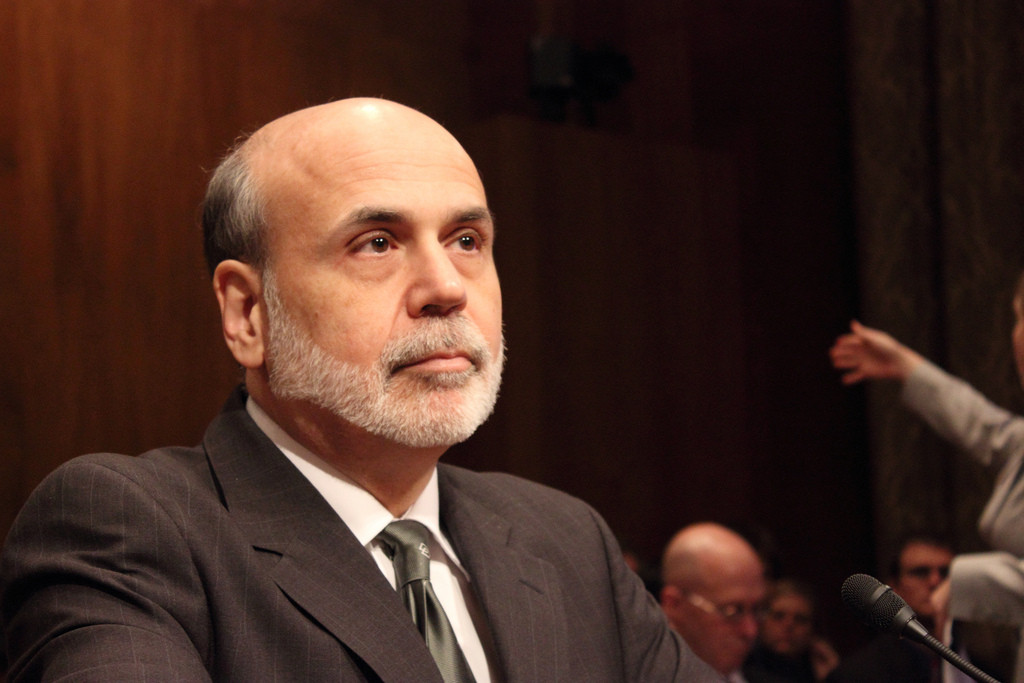

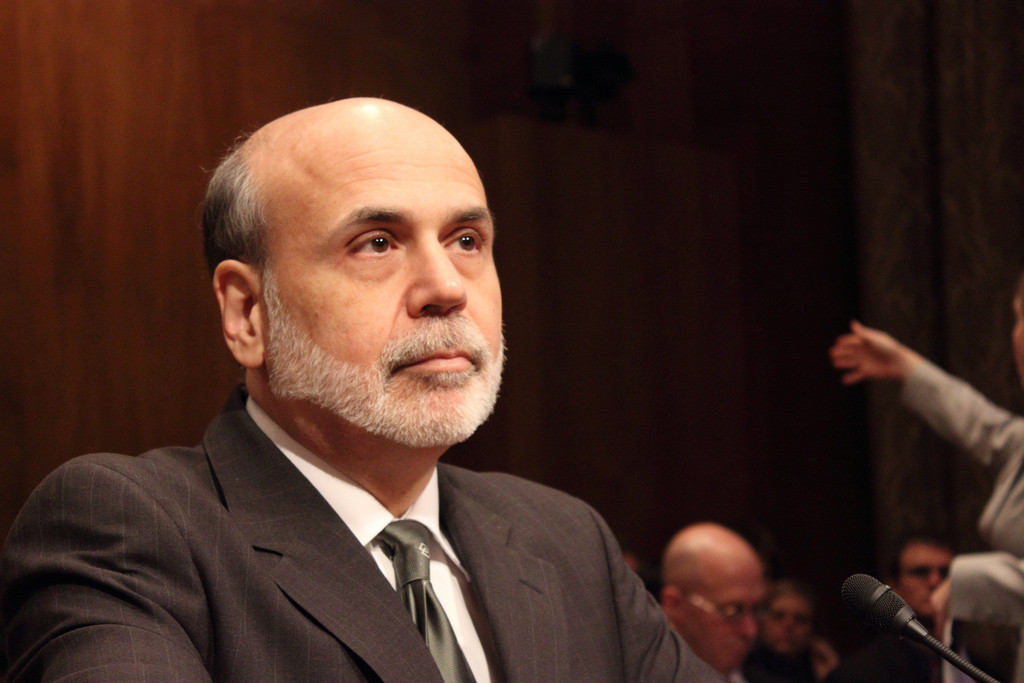

Ben Bernanke and the Fed announced after a two day Federal Open Market Committee meeting another quantitative easing measure, suggesting they would purchase $40-billion mortgage debt each month.

Hidden in the announcement is the statement that unemployment will remain above 7.5% through 2015.

According to the San Francisco Chronicle, “The Fed said it will continue its program to swap $667 billion of short-term debt with longer-term securities to lengthen the average maturity of its holdings, an action dubbed Operation Twist. The central bank will also continue reinvesting its portfolio of maturing housing debt into agency mortgage- backed securities.”